Perception vs Probabilities

Introduction

Would you be interested to read this post if I told you that there is a way to reduce errors by getting on your statistical lenses on. Don’t get me wrong here I am not talking about accurately predicting the future to avoid any mistakes you would make if you took a certain course of action, I am only referring to how you can improve your decision making considering past event’s and new data. Thomas Bayes discovered the bayesian theorem which makes it possible for us to make what I like to call “quantitative decisions” , decisions based on pure math and statistics in order to choose the best course of action.

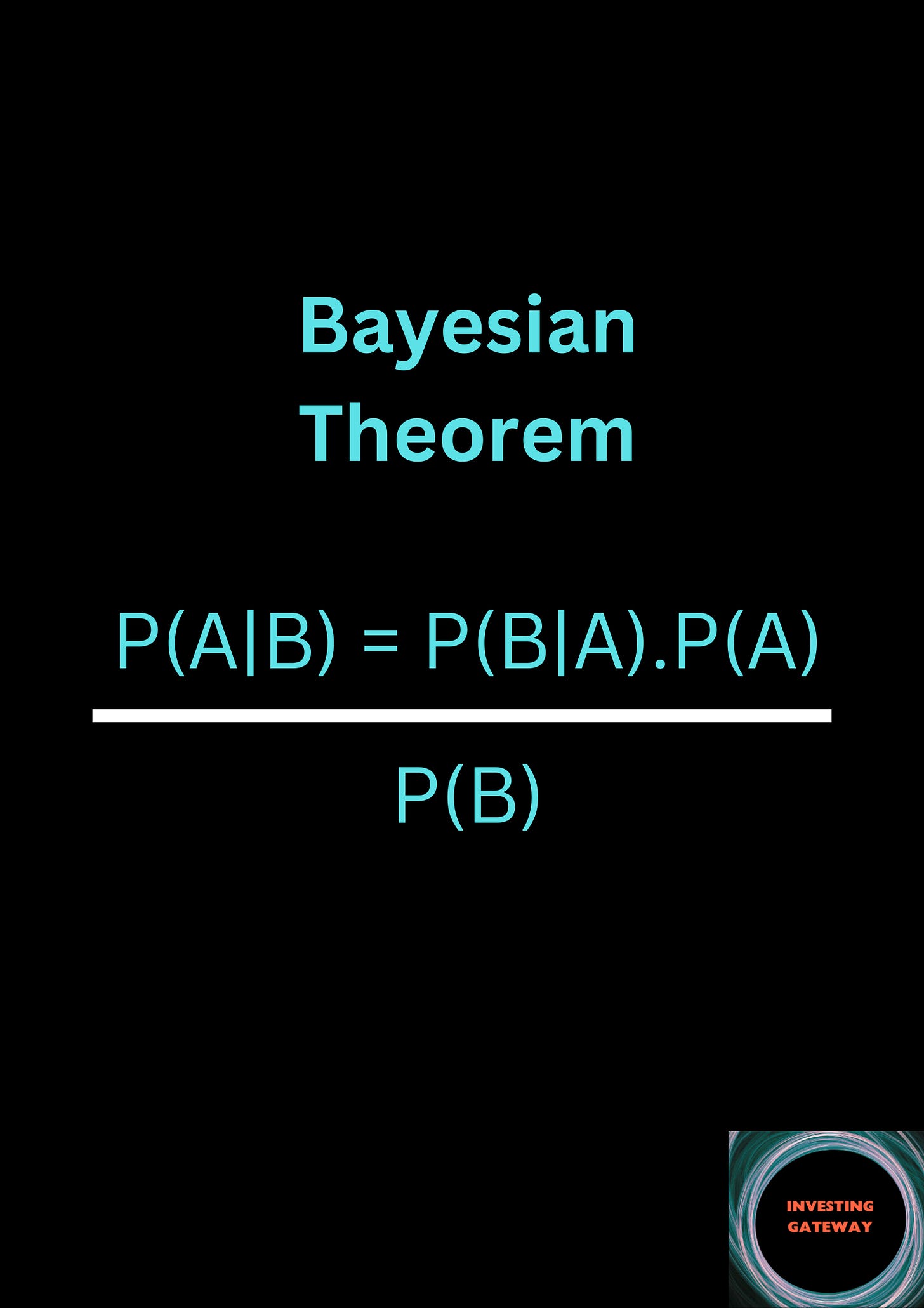

Bayesian Theorem

As I tried explaining above bayesian theorem is basically just taking the base rates (probability of an event happening or not based on the past / historical data) and multiplying these base rates with posterior odds (probability of a new event that has occurred).

Farnham street explains bayesian theorem in simpler words, “ The core of Bayesian thinking (or Bayesian updating, as it can be called) is this: given that we have limited but useful information about the world, and are constantly encountering new information, we should probably take into account what we already know when we learn something new. As much of it as possible. Bayesian thinking allows us to use all relevant prior information in making decisions. Statisticians might call it a base rate, taking in outside information about past situations like the one you’re in.”

Thomas Bayes shared this formula to back his theory, don’t get overwhelmed since this formula translates to base rates / prior odds X posterior odds.

Attaching Weights

First up what do I mean by attaching weights? What weights am I referring to? If you look closely at the formula above you will realise that P(A|B) would be a result of a conditional probability operation. In other words we are trying to infer that the probability of either event A occurring is more than event B occurring or vice versa, we can only ensure this by ‘attaching weights’ to increase an event’s significance in our probabilistic calculations.

Let me tell you it is a very tough job (it’s an art) attaching weights accurately to new event probabilities since many bias’s kick in and most situations tend to be complex, hence every data point makes a claim at being included, sometimes you might even make an error of omission and completely ignore a new but relevant data point which could’ve proven vital in the future. To elaborate more, on attaching weights correctly to data points we all know that there are consequences to our actions and those consequences create more consequences as per the theory of second order effects, this creates a world of endless possibilities, the possibilities of unthinkable things and more importantly complex situations with thousands of data points. Endless possibilities & complex situations make it almost impossible for anyone to predict the future but that doesn’t stop the bayesians on making calculated estimates and choosing the best possible outcomes using math.

In her video Julia Galef explains what attaching weights means in the real world. The part I want to highlight from the video is the part where she gives an example of getting into an accident whilst having a belief that she is a good driver. There are two probabilities in play here, since she thinks that she is a good driver the prior odds are in her favour but the posterior odds say otherwise since good drivers have a lower chance of getting into an accident, this when plugged into the bayes rule would tell Julia that she should be less confident of being a good driver. What you need to be fascinated about is that since it was the other persons fault we attach less weights to the accident and come up with a conclusion that Julia is still a good driver however she isn’t as good as she thinks. (my point is notice how she attaches weights to all events)

It’s a 3.24 min video check it out, if you are short on time and want to hear Julia on this example skip to after 2 mins into the video.

Manhattan Restaurants : The fatal mistake

Anyone who has done their homework on Manhattan restaurants or has read the article “The Thrill of Losing Money by Investing in a Manhattan Restaurant” by Gary Sernovitz would know that it’s best to stay away from investing or running an ordinary restaurant business in Manhattan, why because the base rates say so. In the article Gary mentions that without any significant moat a restaurant in manhattan is highly unlikely to survive, just like the restaurant he was vested in, in the article.

Gary writes in his article, “For another perspective, I talked to Andrew Yang, the principal investor of a successful restaurant, Danny Bowien’s Mission Chinese Food. Yang—who comes from a restaurant family—brought some necessary context to the complaint that restaurant investing is otherworldly difficult. “Like any business in New York City,” he told me, “you need to have a product that is above and beyond—better than everyone else’s. You need all the details to get it right, the right execution, the right package, the right branding around it, and you need to have a clear competitive advantage in each.” In his case, that meant a name-brand chef and a unique cuisine, one not easily replicable and one that lends itself to the more subdued rents of Chinatown and the reasonably priced ingredients of Chinese food.”

If Manhattan restaurants are so ill fated and judging by the article and by reality that the prior odds or the base rates of running a successful restaurant in Manhattan are so little in favour of the investor, if I were to use my knowledge of bayes rule then right now in my head I can hear a voice telling me that base rates dictate that 90% investors will fail and even if they get a ground breaking idea of a new restaurant startup idea the odds might still be against them lets say 60-40 at best. Then why fall into this trap at all? The answer lies in perception, the answer lies in making the fatal error of attaching the wrong weights to the wrong data points because your bias’s have clouded your judgment. One obvious bias that you and I would point out is survivorship bias in this case, Mr Yang’s restaurant is one of those many data points which is visible and easily available too sway our base rates from reality and give us a false picture of the situation. In our case however there is more than one very available data point which Gary highlighted in his article

“But the biggest temptation might be the paradox of New York restaurant supply and demand—a paradox that feels beatable. That is, New York City, with all its pastrami-and-pizza-hungry tourists and residents fleeing their pocket-size kitchens and young people too busy taking phone pictures of one another to cook, generates enormous demand for restaurants. There are twenty-four thousand of them in five boroughs. That demand should, one imagines, set restaurant-meal prices at the level that affords some baseline health for the suppliers of those meals.”

This is purely the perception of investors, there’s no thought given to why the demand is so high and wether there is enough supply already to match it because the noise around this subject hides all the relevant data points, all the media all the “tourists taking pictures” are just out there hiding the truth in plain sight creating a mirage of a minting mine in the minds of investors. Overcoming this false perception translates to looking into base rates and re-testing those base rates to ensure that you have attached the weights properly. However, this very perception would’ve made it difficult as an investor to attach the right weights to the base rates but you would’ve eventually gotten there either by deep diving into the competitive environment or by bitter experience. (you see my point here)

Conclusion

I know that maths overwhelms many of us but I don’t care about the math here, all I care about is Thomas Bayes’s ideology. There is no rule telling us how to attach weights to new data(posterior odds) or old data (base rates) it’s an art and you can’tt always get it right but even a feeble attempt at it can change your perspective and open up your mind to otherwise unforeseeable outcomes. The Bayes rule helps you keep up with the dynamically changing situation, just plug in the numbers and surf through any complex situation let probabilities take care of the rest.